State Life Insurance-Salary Saving Plan-Individual Life Plan-Bonus Rates. State Life Insurance Corporation is also famous as SLIC which consider the largest Life Insurance Company of Pakistan. It has about 200000 agency network all over Pakistan. Its owner is the Government of Pakistan and it has established in 1972. Its recently headquarter working from Karachi city.

In this article, I will completely clear your doubts about SLIC and will completely guide you about State Life Insurance Policy, Salary Saving Plan, Individual Life Plan, Bonus Rates, Group Life & Pension Plans, and Health Insurance.

State Life Insurance-Salary Saving Plan-Individual Life Plan-Bonus Rates

Salary Saving Plan

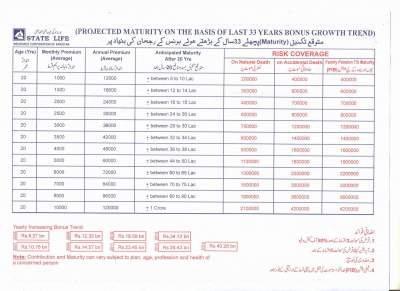

State Life introduced a new policy that is Salary Saving Plan, its main motive is to encourage the culture of saving among the Pakistani Nation.

Introduction

This plan is introduced for the employees of any organization of Pakistan with easy and affordable options. This plan enhanced features for the employees and their families. Salar Saving Plan is a straight forward, flexible and systematic plan.

In this, you are to deposit tiny monthly premium or instaalments and in results, it provides high-risk coverage for State Life Insurance Policyholders and their families. This small deposit premium will never affect your personal budget.

Salary Saving Plan Benefits

- This plan is very easy, understandable and automatic.

- Save at a young age and it will provide you in old age.

- It is family protection after death.

- This plan encourages the environment of saving and then spend afterward.

- It gives high maturity benefits than other policies.

- In the case of death, it gives an average of Rs 1000000 for an individual employee.

- This plan includes a pension for nominees.

State Life Insurance Individual Life Plans

Individual Life Plans includes the following categories on which you may get this policy. To get more details about these categories Click Here

- Whole Life Assurance

- Endowment Assurance

- Sadabahar Plan

- Anticipated Endowment Assurance

- Shad Abad Assurance

- Jeevan Saathi Assurance

- Child Education & Marriage Assurance

- Child Protection Assurance

- Shehnai Policy

- Sunheri Policy

- Optional Maturity Endowment

- Nigehban Plan

- Muhafaz Plus Assurance

- Supplementary Covers

- Committee Policy

State Life Insurance Policy Bonus Rates

State Life Insurance offers good and attractive bonus rates. The following are the types of bonus rates for different plans. To check all bonus rates Click Here

- Reversionary bonus

- Special Reversionary bonus

- Super (Table 72), Sunehri (Table 73) & Shehnai (Table 77) Policies

- Committee Policy (Table 79)

- Personal Pension Scheme (Table 71)

- Family Income Benefits in course of payment

- Terminal bonus

- Special Terminal bonus

- Terminal bonus for (With Profit Tables/Plans) PAID-UP Policies

- Loyalty Terminal Bonus

- Loyalty Terminal Bonus for (With Profit Tables / Plans) PAID-UP Policies

- Thirtieth Anniversary bonus

- Millennium bonus

- Golden Jubilee bonus

- One Time bonus

State Life Insurance Group Life & Pension Plan

Group Life Insurance

Group Life Insurance Plan provides life insurance for the members of the group. For more detail Click here

Group Life Insurance Plan Benefits

On the death of any insured member, the sum assured will be paid to his family and if any 3 years periods State Life earns a net profit on any policy, then some share in the profit is passed on to the policyholder.

Added Riders In Group Life Insurance Plan

1= Accident Rider

If a person gets permanent or total disability during accidents then this member is entitled to the sum assured. It includes loss of two limbs, two eyes, or loss of both ears.

2= A.D.B Rider

The death benefit of this assured rider is doubled if the death caused due to accident.

3= Critical Illness Rider

If a person is assured in Group Life Plan and he suffers from the following critical illness then he is entitled to the rider sum assured,

- Heart attack

- Coronary Artery by-pass surgery

- Stroke

- Cancer

- Kidney Failure

- Major organ transplants such as heart, kidney or liver

State Life Insurance Pension Plan

If a person working life is over or he is retired from his active service then the State life pension scheme is only sourcing to provide monthly income when other sources of income stops.

What is the Pension Plan or Scheme?

Actually this is a saving or contribution plan which is collected during the working like of a person. After retirement from active service then he is entitled to get steady monthly income from this plan which he built up from the earlier savings. For more information about Pension Plan Click Here

- Latest CMH Jobs in Rawalpindi July 2024 Advertisement

- Latest Custom Sepoy Jobs in Pakistan 2024 Application Form

- Govt Jobs in Prime Minister Office Islamabad July 2024

- FBR Custom Jobs July 2024

- AFNS Jobs 2024 as a Female Lieutenant Registration Last Date

- Govt Hospital Jobs in Punjab 2024

- FIA Latest Jobs 2024 For Males and Females

- Punjab Police Counter Terrorism Department CTD Corporal Jobs 2024

- Specialized Healthcare Jobs 2024 NTS Application Form

- Latest Jobs in Government Departments 2024 Apply Form